Depending on your perspective, NOTL Hydro can be considered a business or a government entity. There are valid arguments for both considerations.

Business

Arguments for NOTL Hydro being considered a business include:

- NOTL Hydro is incorporated under the Ontario Business Corporation Act so it is a corporation.

- NOTL Hydro makes a profit and annual profit targets are set by the Board of Directors each year.

- NOTL Hydro has a normal business internal organization structure including staff, management, an executive team and a Board of Directors.

- NOTL Hydro pays income taxes. One wrinkle is that while the taxes are calculated in the normal manner, all the payments are made to the provincial treasurer. This includes the portion that would normally go to the federal government.

- There are shares of NOTL Hydro and these shares could be bought and sold…we just do not currently recommend this.

- Some electricity distributors in Ontario are owned, in whole or in part, by private sector investors so are clearly businesses.

Government

There are also arguments as to why NOTL Hydro could be considered a part of government.

- NOTL Hydro is 100% owned by the Town of Niagara-on-the-Lake.

- NOTL Hydro does not have the right to set its own prices on a transaction-by-transaction basis but must follow the prices set by the regulator.

- NOTL Hydro must provide a service to everyone who wants to be a customer and cannot differentiate between customers.

- NOTL Hydro is restricted as to what activities it can engage in. The sister company, ESNI, is not subject to these limitations.

- NOTL Hydro is a local monopoly so residents and businesses in Niagara-on-the-Lake must deal with NOTL Hydro.

- NOTL Hydro operates in an industry in Ontario that is dominated by government entities and has been traditionally managed by government entities.

The answer to this question also varies across municipalities and countries. For instance, in the USA there are hundreds of municipal power utilities that range in size from a few thousand to over a million customers. These are clearly government entities as non- profit and they are often departments of the municipal government. Meanwhile in Alberta, two of the biggest electrical utilities, EPCOR (Edmonton) and ENMAX (Calgary), are municipally owned but are clearly businesses with significant investments outside of both the province and country.

Within Ontario, there is also a range. As mentioned, some municipal utilities have varying degrees of private ownership so are clearly businesses while others are integrated with the municipal operations so are more like a government.

As President, I consider NOTL Hydro a business. I manage it like a business and the Board of Directors directs me like with a business. I always worked in the private sector prior to this so managing a business is what comes to me naturally.

There is one important difference between most businesses and NOTL Hydro. Most businesses operate to maximize their profits in the long run. This usually means offering good service and a fair price as that is the best strategy for long term success. At NOTL Hydro we have not tried to maximize the long-term profit. Our shareholders are our customers so trade-offs have been made as maximizing profits could also mean maximizing rates. Instead, we try to find the right balance between good profits and low rates.

Every year a target net income is set by the Board of Directors as part of the budgeting process and this funds the annual dividend that we pay the Town as well as ongoing investments. NOTL Hydro has structured its operations so that we do not maximize the investment we make in our system.

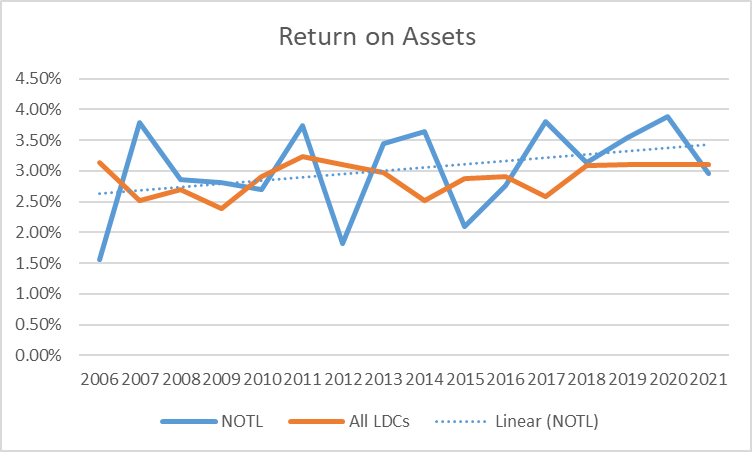

The regulatory process in Ontario allows electric utilities to set rates that recover operating costs and earn a return on their assets. As can be seen in the chart below, NOTL Hydro makes a return on assets comparable to other electric utilities in Ontario. Our operating costs are comparable to other utilities so NOTL Hydro keeps their rates low by maintaining a lower asset base.

However, NOTL Hydro will never pass on an investment if that would be detrimental to reliability. As I discussed in the July 13 blog, reliability is very important to us. https://www.notlhydro.com/outages-blog/